does nh tax food

A Alaska Delaware Montana New Hampshire and Oregon do not levy taxes on groceries candy or. No state sales tax.

New York Tax Rates Rankings New York State Taxes Tax Foundation

Even this tax is set to be phased out soon.

. However each of these. As a result the. Please note that effective October 1 2021 the Meals Rentals Tax rate is reduced from 9 to 85.

The tax is 625 of the sales price of the meal. There are no local taxes beyond the state rate. A 7 tax on phone services also exists in NH.

Motor vehicle fees other than the Motor Vehicle Rental Tax are administered by the NH. Tax rate Does general sales tax apply. No capital gains tax.

The New Hampshire income tax has one tax bracket with a maximum marginal income tax of 500 as of 2022. If calling to inquire about the purchase of. There are special liquor licenses that allow establishments to serve or sell booze without food.

A net rate of 17 is now allocated as 04 AC and 13 UI. New Hampshire does collect. Prepared Food is subject to special sales tax rates under New Hampshire law.

New Hampshire Consumer Taxes at a Glance New Hampshire does not have a sales tax and has some of the lowest gasoline taxes in the country. Tax is 500 or greater. Beginning in 2023 the tax will be reduced by a percentage point before being completely repealed after December 31 2026.

Call the Departments Tobacco Tax Group at 603 230-4359 or write to the NH DRA Tobacco Tax Group PO Box 1388 Concord NH 03302-1388. Does nh tax food. The Tobacco Tax and the Communications Services Tax exemplify some of the risks of relying on relatively small revenue sources dependent on certain types of economic activity.

The national average sales tax rate is around 511. A New Hampshire FoodBeverage Tax can only be obtained through an authorized government agency. Since the state controls all liquor sales it.

No inheritance or estate taxes. The tax is paid by the. Tax policy in New.

Is food tax exempt in all states. There is currently a 9 sales tax in NH on prepared meals in restaurants along with the same rate on short-term room rentals and car rentals. New Hampshire does not exempt any types of purchase from the state sales tax.

New hampshire rules vary greatly from federal laws and include the business profits tax business enterprise tax and rooms and meals tax. Depending on the type of business where youre doing business and. The state of New Hampshire has no sales tax.

These excises include a 9 tax on restaurants and. Please note that effective october. A New Hampshire Meals Tax Restaurant Tax can only be obtained through an authorized government agency.

The New Hampshire income tax has one tax bracket with a maximum marginal income tax of 500 as of 2022. In most states necessities. Property taxes that vary by town.

Limited NHFUK we or our trades meat cuts largely on behalf of its ultimate parent company NH Foods Limited NHFJP which is listed in Japan. There are however several specific taxes levied on particular services or products. They would pay 180 in taxes because the 5 tax only applies to the 3600 above their exemption.

Depending on the type of business where youre doing business and other specific. Sales Tax Treatment of Groceries Candy Soda as of July January 1 2019. These excises include a 9 tax on.

Tax rate Does general sales tax apply. New Hampshire Sales Tax. Alcohol excise tax rates 2017 in dollars per gallon State Liquor Wine Beer Tax rate Does general sales tax apply.

New Hampshire is one of the few states with no statewide sales tax. The elimination of the tax would. The Granite States low tax burden is a result of.

2021 Sales Tax Rates State Local Sales Tax By State Tax Foundation

Understanding California S Sales Tax

Tennessee Sales Tax Holidays Offer Opportunities To Save The Courier

New Hampshire Sales Tax Rate 2022

General Sales Taxes And Gross Receipts Taxes Urban Institute

Why Are Minnesotans So Overtaxed American Experiment

State Sales Tax On Groceries Ff 09 20 2021 Tax Policy Center

Some States Tax At Least Some Food Items Don T Mess With Taxes

New Hampshire Retirement Tax Friendliness Smartasset

:max_bytes(150000):strip_icc()/5_states_without_sales_tax-5bfc38cbc9e77c00519e5498.jpg)

Which States Have The Lowest Sales Tax

Sales Tax Laws By State Ultimate Guide For Business Owners

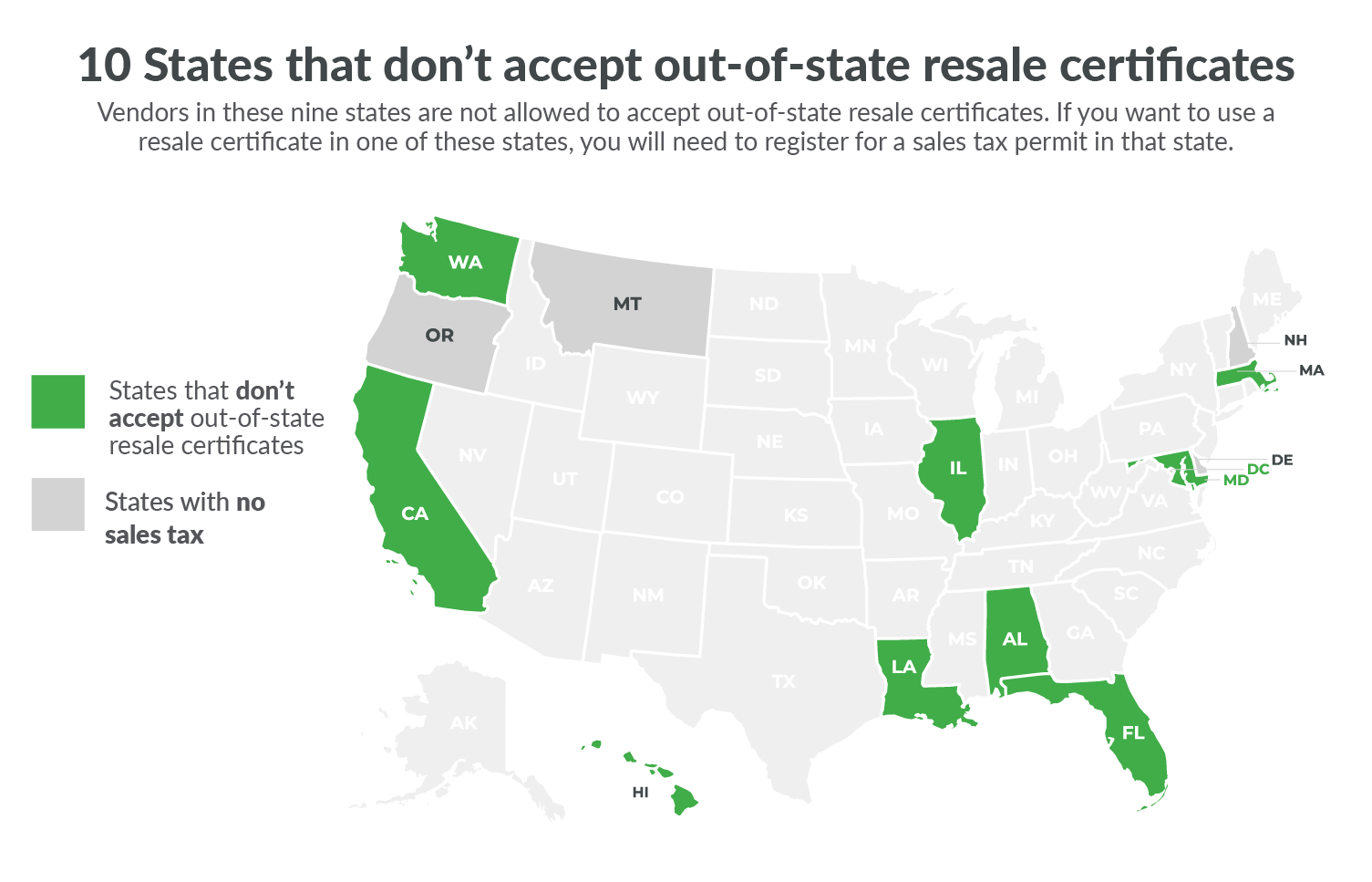

10 States That Won T Accept Your Out Of State Resale Certificate Taxjar

New Jersey Sales Tax Calculator And Local Rates 2021 Wise

Washington Dc District Of Columbia Sales Tax Rates Rates Calculator

The N H Mass Tax Fight Could Have Implications That Go Far Beyond Our Borders The Boston Globe

Sales Taxes In The United States Wikipedia

Nh Meals And Rooms Tax Decreasing By 0 5 Starting Friday Manchester Ink Link